Learning Corner

Blog Corner

Spender, Saver, Wealth Creator: Which One Do You Want To Be?

People’s approach to money management can be segmented into three categories: Spender/Debtor, Saver, and Wealth Creator. The category in which people fall depends a great deal on their past and what they were taught or observed as they were growing up.

Spender/Debtor

There are people and families, regardless of their income, that would be considered “spenders/debtors.” They take on debt through credit cards or other sources to fund their purchases. They then spend their time paying that debt down to zero. When it’s time to make the next purchase, they take on debt again and continue the cycle. This is referred to as living below the zero lines or hamster wheel finance.

Saver

The Saver personality is the polar opposite of the Spender. They avoid debt as much as possible and prefer to pay cash for all of their purchases. Savers are good at putting money aside for their purchases. When they have saved enough and the purchase is made, the cash is depleted and they start again. This is referred to as living above the zero lines.

In principle, there is nothing wrong with the Saver approach. Queens Bridge Financial Strategy believes there is a better way to achieve the same goals while maintaining Liquidity, Use, Control, and Knowledge that your money is working for you (LUCK).

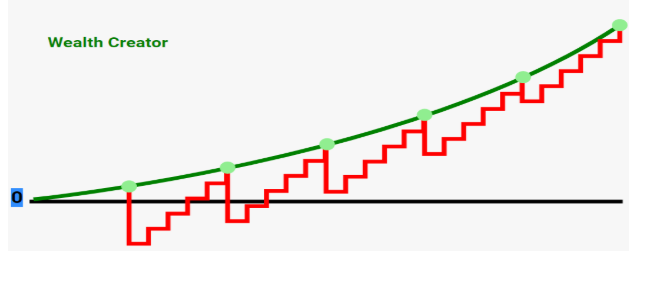

Wealth Creator

The wealth creator is a blended model of the debtor and the saver, with one major difference. Wealth Creators use LUCK for their money at all times.

All wealth begins with a savings component (green line in the chart below). The biggest difference is that when a purchase needs to be made (red lines), the savings are not depleted. In fact, the savings are allowed to grow and compound uninterrupted over time. In this situation, the Wealth Creator keeps control of their money never handing their savings over. Purchases are made and paid from monthly cash flow. At the outset, the Wealth Creator may dip below the zero lines. However, because the savings are not depleted for the purchases, they’re allowed to compound over time, keeping the Wealth Creator above the zero-line long term.

When your green line savings are equal to or greater than your outstanding liabilities, including mortgage, you are now accelerating your wealth creation. Once you have the power to choose to pay out liability in full, even though you don’t have to, you are in complete control of your financial future. Many Wealth Creators choose not to pay out their debts as they continue to want to exert control over their financial affairs rather than depleting savings and missing the uninterrupted compounding opportunity on their money.

Summary

We hope that you can see that the most enviable position is that of the Wealth Creator. The challenge comes in identifying if you are a wealth creator. If not, what steps do you need to take to become one?

Being a Wealth Creator is much more than just a balance sheet exercise of your assets against liabilities. It comes down to the characteristics of your assets. Think LUCK. How much of your assets are considered at risk? What are your assets earning? Are the earnings guaranteed? What types of liabilities do you have? When are those liabilities due? These are just a few questions that we ask when helping people get on track to becoming a Wealth Creator.

People from all walks of life come to us asking for help in becoming Wealth Creators. At the end of the day, it comes down to how serious you are about your financial future. If you are willing to work with us, we can help.